NetWorth+: Personal Finance App for Money Management

Managing personal finances can be overwhelming, especially when juggling expenses, savings, and investments. Spreadsheets and manual tracking often lead to confusion, missed opportunities, and financial stress. That’s where NetWorth+ comes in—a smart, all-in-one personal finance app designed to help you take control of your finances with ease.

1. What is NetWorth+?

NetWorth+ is a comprehensive finance app that simplifies money management by tracking your income, expenses, investments, and overall net worth in real-time.

Whether you want to budget effectively, monitor your financial health, or plan for the future, NetWorth+ gives you the tools to succeed.

With AI-powered insights, smart automation, and user-friendly features, NetWorth+ makes financial tracking seamless for individuals, freelancers, and businesses alike.

2. Key Features of NetWorth+

Managing personal finances can be overwhelming, especially when dealing with multiple accounts, investments, and expenses. NetWorth+ simplifies financial management by offering a range of powerful features designed to help users track, plan, and optimize their money. Below are the key features that make NetWorth+ the best personal finance app for individuals, freelancers, and small business owners.

2.1 Total Asset Management – Monitor All Your Financial Assets in One Place

Keeping track of your net worth requires an accurate picture of all your financial assets. NetWorth+ allows users to link and manage various types of assets, including:

- Bank accounts (Checking, savings, and digital wallets)

- Investments (Stocks, bonds, mutual funds, crypto, and real estate)

- Retirement funds (401(k), Roth IRA, NPS, EPF, etc.)

- Physical assets (Gold, property, cars, and valuable collectibles)

- Liabilities (Loans, mortgages, credit card debt)

If you own a car worth USD 50,000, have USD 30,000 in savings, and an investment portfolio of USD 100,000, but also owe USD 20,000 on a loan, NetWorth+ will calculate and display your real net worth as:

(Total Assets – Liabilities) = (180,000 – 20,000) = USD 160,000

This holistic view helps users understand their financial position and make informed decisions.

2.2 Expense & Income Tracking – Automated Categorization for Smarter Budgeting

Tracking income and expenses is essential for financial success, yet many people struggle to keep up with where their money goes. NetWorth+ simplifies this process with automated tracking and categorization.

How It Works:

- Auto-Import Transactions – Sync bank accounts or manually add expenses.

- Smart Categorization – AI assigns transactions to categories (rent, groceries, utilities, entertainment, etc.).

- Monthly Spending Reports – Provides insights into spending patterns and areas for improvement.

If you earn USD 10,000 per month but consistently spend USD 6,000 on discretionary expenses, NetWorth+ will alert you, helping you adjust your budget and save more.

According to a 2023 survey by Statista, 65% of people who track expenses save more money compared to those who don’t.

2.3 Financial Health Calculator – Assess Your Financial Stability with Smart Insights

Understanding financial health goes beyond checking account balances. NetWorth+ provides a Financial Health Score based on multiple factors like:

- Debt-to-Income Ratio (DTI) – Indicates how much of your income goes toward debt.

- Savings Rate – Helps measure how much you’re saving relative to your earnings.

- Emergency Fund Status – Determines whether you have enough funds to cover unexpected expenses.

A healthy DTI ratio should be below 36%. If your monthly income is USD 12,000 and your loan payments total USD 5,000, your DTI is 41%, which is considered high. NetWorth+ would suggest reducing debt or increasing income to improve financial stability.

Experts recommend having an emergency fund that covers at least 3-6 months of expenses. NetWorth+ helps calculate how much you need and tracks your progress.

2.4 Investment & ROI Calculator – Track and Optimize Your Investments

Investing is crucial for long-term wealth, but monitoring returns on investment (ROI) can be complex. NetWorth+ simplifies this by:

- Tracking all investments in one place (stocks, mutual funds, crypto, real estate).

- Providing ROI calculations to evaluate performance.

- Suggesting adjustments based on financial goals.

If you invested USD 50,000 in stocks and it grows to USD 60,000 in a year, the ROI would be:

ROI = (Profit / Initial Investment) × 100 = (10,000 / 50,000) × 100 = 20%

NetWorth+ helps users analyze if they are meeting their investment targets.

Historically, the stock market has an average annual return of 8-10%. NetWorth+ helps investors compare their returns and adjust their portfolio accordingly.

2.5 AI-Powered Smart Suggestions – Receive Personalized Financial Advice

Unlike traditional budgeting apps, NetWorth+ uses AI to provide:

- Spending alerts when you exceed your budget.

- Investment recommendations based on market trends.

- Personalized savings goals based on your income and spending habits.

If you spend more than 30% of your income on dining out, NetWorth+ may suggest reducing it to 20% and reallocating the savings to investments.

According to Fidelity Investments, people who set specific financial goals are 42% more likely to achieve them.

2.6 Secure & Private Data – Data Encryption and Privacy Protection

Security is a top concern when managing finances online. NetWorth+ ensures bank-level encryption and privacy measures, including:

- End-to-End Encryption – Protects sensitive data.

- Two-Factor Authentication (2FA) – Adds an extra layer of security.

- Zero Data Sharing Policy – User data is not sold or shared with third parties.

Even if someone gains access to your phone, without your password or biometric verification, they cannot access your financial data on NetWorth+.

A 2024 survey by Cybersecurity Ventures found that 91% of cyberattacks begin with compromised passwords. NetWorth+ prioritizes security to keep user data safe.

3. Why Choose NetWorth+ Over Other Finance Apps?

There are many finance apps in the market, such as YNAB (You Need a Budget), Mint, and PocketGuard, but NetWorth+ stands out due to its comprehensive financial tracking, AI-powered insights, and user-friendly interface. Let’s compare NetWorth+ with these popular apps and see why it’s the best choice for managing personal and business finances.

3.1 NetWorth+ vs. YNAB (You Need a Budget)

| Feature | NetWorth+ | YNAB |

| Total Asset Tracking | ✅ Yes (Bank accounts, investments, real estate, crypto, etc.) | ❌ No (Focuses only on budgeting) |

| Automated Expense Categorization | ✅ Yes (AI-based) | ❌ No (Manual entry required) |

| Investment & ROI Tracking | ✅ Yes | ❌ No |

| Financial Health Score | ✅ Yes | ❌ No |

| AI-Powered Smart Suggestions | ✅ Yes | ❌ No |

| One-Time Lifetime Payment Option | ✅ Yes | ❌ No (Subscription-based: $99/year) |

Why NetWorth+ is Better than YNAB?

All-in-One Financial Tracker – YNAB focuses only on budgeting, while NetWorth+ tracks total net worth, investments, and ROI.

AI-Powered Recommendations – YNAB requires manual adjustments, but NetWorth+ automates financial insights.

One-Time Purchase – YNAB requires a monthly or yearly subscription, whereas NetWorth+ offers a one-time payment option, making it more cost-effective.

3.2 NetWorth+ vs. Mint

| Feature | NetWorth+ | Mint |

| Total Asset & Liability Management | ✅ Yes | ❌ No |

| Custom Budgeting & Expense Tracking | ✅ Yes | ✅ Yes |

| Investment & ROI Monitoring | ✅ Yes | ❌ No |

| AI-Powered Financial Planning | ✅ Yes | ❌ No |

| Ad-Free Experience | ✅ Yes | ❌ No (Mint shows ads) |

Why NetWorth+ is Better than Mint?

More than Just Budgeting – Mint primarily focuses on expense tracking, while NetWorth+ provides complete financial management, including investment tracking.

No Ads & Data Privacy – Mint is free but monetizes user data by showing ads, while NetWorth+ prioritizes user privacy.

AI-Driven Suggestions – Mint requires users to manually set and adjust budgets, but NetWorth+ analyzes spending and suggests ways to improve financial health automatically.

3.3 NetWorth+ vs. PocketGuard

| Feature | NetWorth+ | PocketGuard |

| Automated Expense Categorization | ✅ Yes | ✅ Yes |

| AI-Powered Smart Budgeting | ✅ Yes | ❌ No |

| Investment Portfolio Tracking | ✅ Yes | ❌ No |

| Detailed ROI Analysis | ✅ Yes | ❌ No |

| Financial Goal Setting & AI Suggestions | ✅ Yes | ❌ No |

| One-Time Payment Option | ✅ Yes | ❌ No (Subscription-based) |

Why NetWorth+ is Better than PocketGuard?

More Than Just Spending Limits – PocketGuard primarily helps users avoid overspending, while NetWorth+ provides full financial insights.

Tracks Investments & ROI – PocketGuard doesn’t track investments, making it less useful for long-term financial planning.

AI-Powered Financial Planning – NetWorth+ offers smart financial suggestions, while PocketGuard focuses only on budget limits.

3.4 Key Reasons to Choose NetWorth+

Comprehensive Financial Tracking – Unlike competitors that focus only on budgeting, NetWorth+ tracks total assets, liabilities, income, expenses, and investments.

AI-Powered Insights & Smart Suggestions – Automated financial health assessments help users make smarter money decisions.

Investment & ROI Tracking – No need for separate apps to track investments—NetWorth+ does it all in one place.

Privacy & Security First – Unlike free apps that sell user data or show ads, NetWorth+ ensures full data privacy.

Cost-Effective – No recurring fees—a one-time payment option makes NetWorth+ cheaper than subscription-based apps in the long run.

4. Who Can Benefit from NetWorth+?

NetWorth+ is designed for anyone looking to gain complete control over their finances. Whether you are an individual managing personal expenses or a business owner tracking profits, NetWorth+ provides the tools needed to analyze, plan, and grow financial stability.

Individuals & Families (Budgeting and Household Financial Planning)

Managing household expenses can be challenging, especially with multiple income sources, bills, and savings goals. NetWorth+ helps individuals and families:

- Track Monthly Budgets – Set spending limits and automatically categorize expenses.

- Plan for Future Expenses – Allocate money for rent, utilities, groceries, and education.

- Monitor Savings Goals – Set and track goals for vacations, home purchases, or emergency funds.

- Understand Net Worth – Get a complete picture of assets, liabilities, and financial progress over time.

For example, a family looking to buy a home can use NetWorth+ to track savings, compare mortgage options, and calculate future financial commitments.

Freelancers & Self-Employed Professionals (Managing Irregular Income)

Freelancers and self-employed professionals often face fluctuating income and unpredictable expenses. NetWorth+ offers features tailored to their needs:

- Income Tracking – Log multiple income streams from different clients or projects.

- Expense Categorization – Separate business and personal expenses for better financial clarity.

- Tax Preparation – Keep track of deductible expenses and estimated tax liabilities.

- Financial Planning Tools – Plan for months with lower income and adjust spending accordingly.

For instance, a freelance graphic designer earning inconsistent income can use NetWorth+ to track payments, calculate quarterly taxes, and manage cash flow efficiently.

Small Business Owners (Tracking Business Expenses and Profitability)

Small business owners need to track revenue, expenses, and profitability to ensure business growth. NetWorth+ simplifies financial management with:

- Business Expense Tracking – Categorize expenses such as rent, salaries, and utilities.

- Profit and Loss Monitoring – Get real-time insights into revenue and expenses.

- Investment Planning – Track business investments and assess return on investment (ROI).

- Multi-Account Management – Monitor personal and business finances separately in one app.

For example, a café owner can use NetWorth+ to track daily sales, manage vendor payments, and analyze profit trends over time.

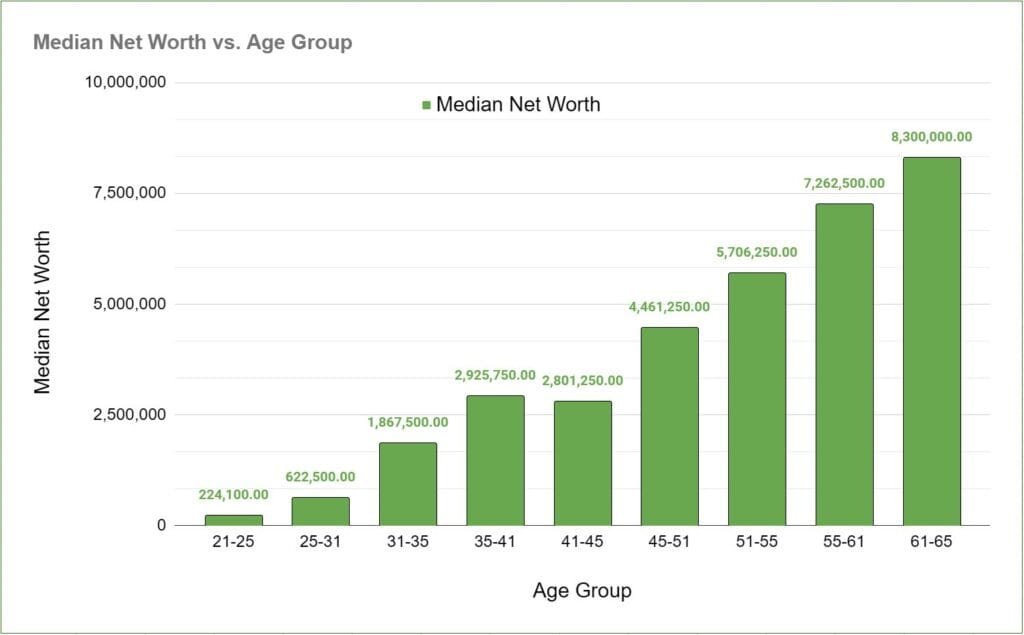

Investors (Monitoring Portfolios and Wealth Accumulation)

For investors, keeping track of multiple assets across different platforms can be time-consuming. NetWorth+ provides:

- Portfolio Tracking – Monitor stocks, mutual funds, real estate, and cryptocurrencies.

- ROI Calculation – Analyze returns and make informed investment decisions.

- Wealth Accumulation Insights – Track net worth growth over time.

- Diversification Analysis – Get insights into asset allocation and risk exposure.

An investor managing stocks, mutual funds, and real estate can use NetWorth+ to consolidate financial data and optimize portfolio performance.

5. Why NetWorth+ is the Right Choice?

NetWorth+ is not just another budgeting app. It provides comprehensive financial tracking that adapts to different financial situations. Whether you are budgeting for daily expenses, managing an unpredictable income, running a business, or growing an investment portfolio, NetWorth+ helps you stay in control of your financial future.

Latest Updates

Download the NetWorth+ App